Mortgage Freedom Plan

Wish to get freedom from mortgage…sure why not?

New Zealand market has seen a significant surge in the house prices in recent years. There are a lot of contributing factors like increased number of migrants leading to population growth, historically low-interest rates, slow housing supply, and strong housing demand to name a few.

When a family goes into the market to buy their first home, they typically have a very low deposit to offer which is available from their KiwiSaver, savings, and support from family. If they buy a decent house worth $800K (which is lower than median house price in Auckland) and offer 20% deposit i.e. $160K, they are looking at a home loan of $640K. If that family would have bought the same house couple of years ago, they would be looking at buying a similar house in the range of $600K or so and if they would have given 20% deposit at that time i.e. $120K, their home loan would have been $480K. What we are trying to say is, the recent increase in the house prices have put pressure on new entrants to the housing market because their home loan size has increased considerably but incomes have not increased in that proportion for everyone.

We have noticed the anxiety, pressure, and fear in young minds because when they are taking a big mortgage on their head, they are taking a big commitment certainly for a long time which they need to honor in all circumstances no matter what. They also need to make sure that they return the full amount of mortgage along with interest to the bank so that they are mortgage free.

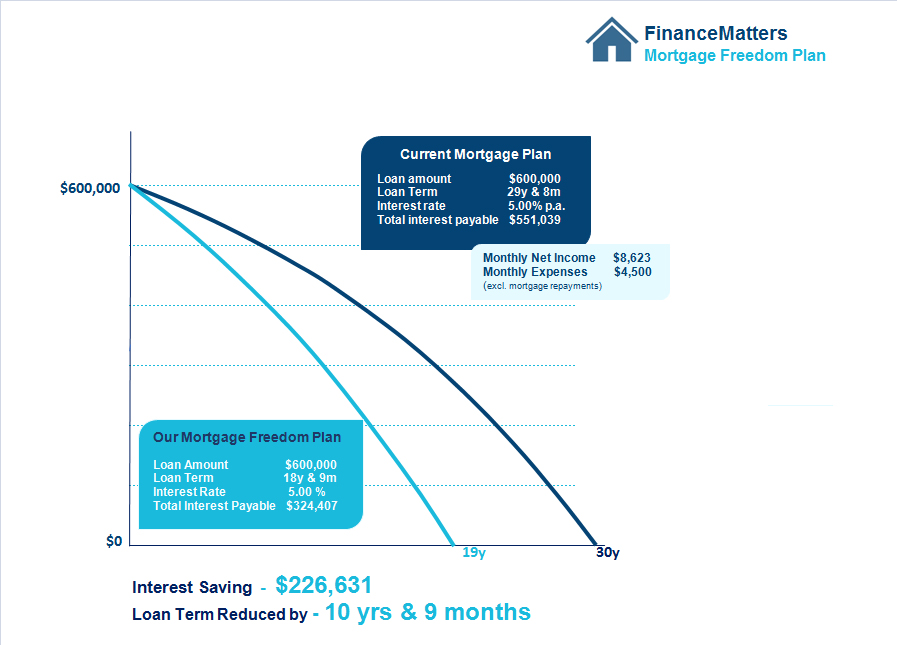

You can’t reduce the principal amount you have borrowed from the bank because that is based on your purchase price and amount of deposit you have put in. At Finance Matters, we guide you to manage your finances in such a way that you get mortgage free sooner and don’t pay unnecessary interest to the bank.

Being the proud owner of your dream home is a great feeling. What you don’t want is the mortgage on your dream home so everyone having mortgage wants to know “How to get mortgage free…faster”. They want to achieve this so that they jump on to the things they have been waiting for a long time during the lifetime of their home loan e.g. go for their dream vacations, upgrade their house, upgrade their car etc. But the real fact is that in order to pay off the mortgage faster, they need to be smarter and make sure that they know which direction they are heading into.

Often, people think that selecting a good loan structure is the only way to get mortgage free faster. In our opinion, loan structure is one essential part out of a range of ways in order to get freedom from your mortgage.

Contact our friendly team at Finance Matters and we can design a personalised plan for you which can help you to become mortgage free faster.